Back To Top

Back To Top

Comment

With Technology finding it’s way into every nook and cranny of our lives, It is no wonder that more emphasis is being placed on Data Security.

However thanks to “Hackers” and the other unethical people that we share this planet with — securing data is becoming increasingly harder in our Information-based society.

In an attempt to increase Security and reduce fraud, hundreds of companies are preparing to “realign” themselves in order to comply with microchip Technology — which many feel offers stronger Security at a cheaper price.

One of the major advocates of this Technology is the Credit industry.

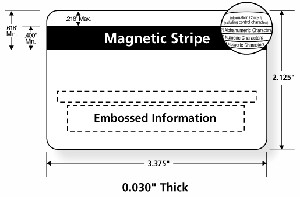

According to the Small Business Association (SBA.gov), nearly all major credit companies are now transitioning from the legacy “Magnetic Strip” that we have all grown so accustomed to — and will now be implementing “Microchipped Cards” in their stead.

According to the Small Business Association (SBA.gov), nearly all major credit companies are now transitioning from the legacy “Magnetic Strip” that we have all grown so accustomed to — and will now be implementing “Microchipped Cards” in their stead.

As stated on SBA.gov:

“U.S. credit card companies are making the transition from magnetic stripe technology to cards with chips. Chip cards are payment cards that have an embedded chip, offering increased security when your customers use the chip to pay in store.”

Advertisement

According to Visa’s Website, the new cards will reportedly boost the Security of your transactions.

The embedded Microchip will enable the card to generate a unique “one-time” security code for each transaction that you make. Because this code will be generated at random, it is nearly impossible to forge.

“When it comes to enhanced security for your customers, chip-activated terminals are taking things to a whole new level. So how does it work? Chip cards and chip-activated terminals work together to protect in-store payments. A unique one-time code is generated behind-the-scenes that is needed for the transaction to be approved—a feature that is virtually impossible to replicate in counterfeit cards.”

In order to ensure that this technology is adopted by all major vendors and outlets, VISA will be updating it’s Liability policy — as a result, any store that does not accept these New cards by VISA could be held responsible for any fraud that occurs as a result.

As stated on their Website:

“Starting October 1, 2015, businesses that don’t accept Visa chip card transactions may be responsible for any resulting counterfeit fraud”

Where do you think this Technology is leading?

Like Us on FB!